Varaha’s $45M Climate Breakthrough: How an Indian Startup Is Scaling Global Carbon Removal with Science, Partnerships, and Profitability

Varaha’s $45M Climate Breakthrough: How an Indian Startup Is Scaling Global Carbon Removal with Science, Partnerships, and Profitability

In the global race to avert the worst impacts of climate change, one challenge has risen from the shadows of emissions reduction: carbon removal — the act of pulling carbon dioxide out of the atmosphere and locking it away durably. Amid this urgent global need, Varaha, an India-founded climate-tech startup, is emerging as a leader in scalable, high-integrity carbon removal that marries cutting-edge science with commercial viability.

In early 2026, Varaha crossed a key milestone: a $45 million Series B funding round led by WestBridge Capital, one of the firm’s first major climate tech commitments. This investment signals a shift in global climate capital flow — from promising pilots to scalable climate infrastructure with measurable impact.

A Powerful Hook: Why Carbon Removal Matters Now

Meeting global net-zero targets no longer relies solely on reducing emissions — it requires literally removing carbon already in the atmosphere. As multinational corporations pledge deep decarbonization and governments tighten climate policy, demand for durable, science-backed carbon removal credits is soaring. Varaha is uniquely positioned to become a major supplier of these credits by deploying solutions in emerging markets that are cost-competitive and scalable.

Varaha’s Funding Story: Big Capital, Bigger Ambitions

Series B: $45M Led by WestBridge Capital

On February 4, 2026, Varaha announced the close of the first $20 million tranche of its Series B round, with the full round sized at approximately $45 million, led by WestBridge Capital. Existing backers RTP Global and Omnivore also participated, underscoring ongoing investor confidence. The capital is earmarked to deepen Varaha’s scientific capabilities, accelerate global expansion, and scale its industrial partnerships model.

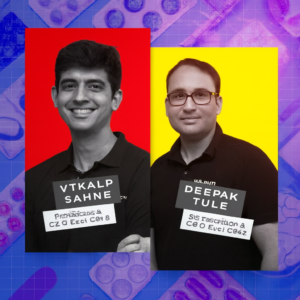

According to Varaha’s founders and investors, this round reflects not just financial backing but a strategic belief in the company’s unique position at the confluence of climate action, emerging market economics, and verification technology. WestBridge’s co-founder and managing partner has publicly stated that the private equity firm views Varaha as a top-three global player in carbon credits and climate infrastructure.

The Strategic Evolution: From Series A to Series B

Varaha’s Series B follows its Series A round in February 2024, led by RTP Global for about $8.7 million, which helped build its initial project portfolio and measurement infrastructure. In late 2025, climate investment firm Mirova committed $30 million to Varaha’s Kheti regenerative agriculture project — marking its largest carbon investment in India and a decisive vote of confidence in Varaha’s approach.

These funding milestones chart rapid evolution — from early product-market fit in India and South Asia to a robust global strategy that positions Varaha at the forefront of carbon removal supply chains.

What Varaha Actually Does: Multi-Pathway Carbon Removal

Varaha’s climate model stands out for its emphasis on multiple validated carbon removal pathways that are scientifically rigorous:

-

Biochar production, turning agricultural biomass into carbon-rich charcoal that stays stable in soil for centuries

-

Afforestation, Reforestation, and Revegetation (ARR)

-

Regenerative agriculture practices that boost soil organic carbon

-

Enhanced rock weathering (ERW), a cutting-edge method that accelerates natural carbon sequestration

These are not theoretical concepts — they are actively deployed, monitored, and verified projects that have delivered real results across several countries.

Varaha operates in India, Nepal, Bangladesh, Bhutan, and Côte d’Ivoire, working closely with smallholder farmers and local partners to implement climate-positive practices at scale. This combination of rural economic development and carbon removal underscores a holistic climate impact model that brings environmental and social benefits together.

Innovation in Integrity: The Varaha Industrial Partners Program (VIPP)

A key growth lever enabled by the Series B funding is the Varaha Industrial Partners Program (VIPP) — a partnership model that allows industrial operators with sustainable biomass and gasification capacity to generate carbon removal credits using Varaha’s Measurement, Reporting & Verification (MRV) systems.

Rather than building and owning all project assets, Varaha is enabling existing operators to plug into its scientific and digital ecosystem, dramatically accelerating the deployment of verified biochar and other removal credits globally.

This strategic shift — from asset ownership to platform-oriented partnerships — gives Varaha the flexibility to scale rapidly across geographies while preserving scientific rigor.

Corporate Demand and Commercial Traction

Companies are not just funding Varaha; they are buying its removal credits.

In January 2026, Varaha signed a significant carbon removal agreement with Microsoft, under which the tech giant will purchase more than 100,000 tonnes of carbon dioxide removal credits over three years from biochar projects in India’s cotton belt.

Microsoft’s commitment reflects a broader corporate mandate toward durable climate solutions, and positions Varaha as a trusted supplier of high-integrity removal credits. Long-term offtakes like these are vital for revenue predictability in a market where credibility and measurement certainty are paramount.

Beyond Microsoft, Varaha has executed offtake agreements with other global corporations, including Google, validating its removal solutions in markets where buyers increasingly scrutinize scientific rigor and permanence.

Why Varaha’s Model Matters

Carbon removal markets are at a crucial inflection point: buyers demand transparency, scalability, and scientific credibility — not just traditional “offsets.” Varaha delivers on all three by:

-

Rooting operations in regions with cost advantages and dense agricultural supply systems

-

Committing to rigorous MRV and verified standards that meet international registries

-

Partnering with industry players rather than building every asset itself

This blend of science, economics, and partnerships puts Varaha on a trajectory to shape the future of climate action — especially in using emerging market ecosystems to drive global solutions.

The Road Ahead: Scaling Climate Impact

With strong investor backing, growing corporate demand, and an expanding global footprint, Varaha is well positioned to become a cornerstone of the carbon removal economy. As climate policy tightens and companies race to meet net-zero commitments, verified carbon removal is rapidly moving from concept to commercial imperative.

Varaha’s story is not just about carbon credits — it’s about demonstrating how science-led climate innovation rooted in emerging markets can scale responsibly, deliver rural economic benefits, and accelerate the world toward a more sustainable future.