Hero MotoCorp Invests Rs 124 Crore into Ather Energy: Valuation Up 20% at Rs 5,636 Crore

Introduction: Hero MotoCorp’s Strategic Investment in Ather Energy

Hero MotoCorp has taken a bold step by investing Rs 124 crore into , a leading electric scooter manufacturer. This move has increased Hero’s stake in Ather to over 40%, highlighting Hero’s commitment to the burgeoning electric vehicle (EV) market. This strategic investment is a clear indication of Hero MotoCorp’s intent to lead the transition towards sustainable mobility solutions.

Founders’ Journey: The Visionaries Behind Ather Energy

Ather Energy was founded by Tarun Mehta and Swapnil Jain, who envisioned a future driven by clean, efficient, and technologically advanced electric vehicles. Since its inception, Ather has been at the forefront of innovation in the electric scooter segment. The founders’ relentless pursuit of excellence and commitment to sustainable mobility has transformed Ather into a significant player in the EV market.

Fundraising Rationale: Why Ather Energy Needed New Investment

Despite its impressive growth, Ather Energy has faced financial challenges, including a slight revenue dip and substantial net losses. The recent investment by Hero MotoCorp and other funding rounds are aimed at stabilizing Ather’s finances and supporting its ambitious growth plans. The infusion of capital is crucial for Ather to scale its operations and maintain its competitive edge.

Utilization Plan: How Ather Energy Plans to Use the New Funds

Ather Energy plans to utilize the new funds to expand its production capacity and enhance its product offerings. The company aims to increase its annual production from 150,000 vehicles to 450,000 vehicles, particularly with the introduction of its new ‘Rizta’ scooter range. Additionally, Ather intends to invest in research and development to innovate and improve its existing product lineup.

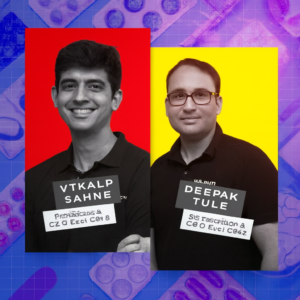

Core Team Spotlight: Key Players Driving Ather’s Success

Ather’s success is driven by a dedicated team of professionals who bring a wealth of experience and expertise to the company. Key players include the founders, Tarun Mehta and Swapnil Jain, as well as other senior executives who are instrumental in steering Ather towards its goals. Their leadership and vision are pivotal in navigating the challenges of the competitive EV market.

Financial Landscape: Navigating Revenue Dips and Losses

Ather Energy reported a turnover of Rs 1,753 crore for FY24, slightly down from Rs 1,784 crore in FY23. Despite this, the company continues to face net losses, which stood at Rs 864 crore in FY23. The recent investments are expected to help Ather overcome these financial hurdles and achieve a more stable and profitable financial standing.

Competitive Landscape: Ather vs. Ola Electric, TVS, and Bajaj

Ather Energy operates in a highly competitive market, with major players like Ola Electric, TVS, and Bajaj vying for dominance. Each competitor brings unique strengths to the table, making the market dynamic and challenging. Ather’s focus on innovation, quality, and customer satisfaction sets it apart and helps it maintain a strong market presence.

Investor Dynamics: Changes in Ather Energy’s Investor Base

Significant changes have occurred in Ather’s investor landscape. Flipkart co-founder Sachin Bansal, an early backer of Ather, has sold a substantial portion of his shares to Zerodha co-founder Nikhil Kamath and is considering divesting his remaining stake. These changes reflect the evolving nature of Ather’s investor base and the growing interest in the company’s potential.

Product Expansion: Launch of the ‘Rizta’ Scooter Range

In April 2024, Ather launched its new ‘Rizta’ scooter range, targeting the family segment. This strategic product expansion is designed to cater to a broader customer base and drive increased sales. The Rizta scooters are expected to play a crucial role in achieving Ather’s production and market share goals.

Production Scaling: Increasing Capacity to Meet Demand

To meet the growing demand for electric scooters, Ather plans to scale its production capacity significantly. The company aims to increase its annual production capacity to 450,000 vehicles, aligning with its market expansion and product launch strategies. This scaling up is vital for Ather to compete effectively and fulfill customer demand.

Market Valuation: Ather’s Growing Worth and Market Position

The latest investment by Hero MotoCorp has raised Ather’s inferred valuation to Rs 5,636 crore, up from Rs 4,666 crore in the previous funding round. This increase in valuation reflects Ather’s growing prominence and potential in the electric scooter market. It also underscores the confidence that investors have in Ather’s future prospects.

Hero MotoCorp’s EV Strategy: Commitment to Sustainable Mobility

Hero MotoCorp’s continued investment in Ather Energy is part of its broader strategy to lead the EV transition. Hero’s commitment to sustainable mobility is evident in its support for Ather’s innovative products and growth plans. By strengthening its stake in Ather, Hero MotoCorp is positioning itself as a key player in the future of electric transportation.

Future Outlook: What’s Next for Ather Energy and Hero MotoCorp?

Looking ahead, Ather Energy is poised for significant growth and transformation. With the support of Hero MotoCorp and other investors, Ather aims to expand its market presence, enhance its product offerings, and achieve financial stability. The future looks promising for both Ather Energy and Hero MotoCorp as they drive the shift towards electric mobility.

Conclusion: Implications of the Investment for the EV Market

Hero MotoCorp’s investment in Ather Energy has far-reaching implications for the EV market. It signals a strong vote of confidence in Ather’s potential and the overall growth prospects of the electric scooter segment. As Ather continues to innovate and expand, it is well-positioned to lead the charge in the transition to sustainable, electric transportation.

Stay tuned for more updates on the evolving landscape of the electric vehicle industry and the exciting developments at Ather Energy and Hero MotoCorp.

1 thought on “Hero MotoCorp Invests Rs 124 Crore into Ather Energy: Valuation Up 20% at Rs 5,636 Crore”