Juspay Raises $60 Million in Mixed Primary-Secondary Round Led by Kedaara Capital; Valuation Surges to Over $900 Million

Juspay Raises $60 Million in Secondary Funding from Kedaara Capital; Valuation Soars to Over $900 Million

Bengaluru-based fintech powerhouse, Juspay, has closed a $60 million secondary funding round led by Kedaara Capital, doubling its valuation to over $900 million. This milestone marks a significant vote of confidence from investors in Juspay’s role as a critical enabler of India’s digital payment ecosystem.

About the Funding Round

This $60 million investment comes in the form of a secondary transaction, meaning existing shareholders sold part of their stakes to new investors. No fresh capital was infused directly into the company. While Juspay itself won’t use these funds for expansion, the move reflects strong external interest in the company’s success and long-term potential.

What Does Juspay Do?

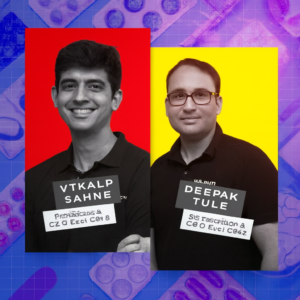

Founded in 2012 by Vimal Kumar, Juspay provides a payment orchestration platform — a backend layer that simplifies digital transactions for businesses. It ensures secure, seamless, and fast checkout experiences by integrating with multiple payment gateways, UPI systems, banks, and wallets.

Key Features of Juspay’s Platform:

-

Smart Routing to reduce payment failures

-

Tokenization for secure card storage

-

Custom checkout UI for better UX

-

UPI stack integration with high reliability

-

Analytics & fraud detection tools

Clients:

Some of the largest consumer tech brands use Juspay, including:

-

Amazon

-

Swiggy

-

Flipkart

-

PhonePe

-

Ola

Juspay handles over 12 million transactions per day, making it one of the largest players in India’s fintech backend infrastructure.

Why Has Juspay’s Valuation Doubled?

Juspay’s current valuation of over $900 million — double what it was in 2021 — can be attributed to:

Strong Client Portfolio

Juspay powers payments for India’s biggest tech companies.

Digital Payments Boom

With over 10 billion UPI transactions monthly, demand for Juspay’s solutions has skyrocketed.

Operational Efficiency

Juspay has been lean and cost-efficient, aligning well with investor focus on profitability.

Technological Edge

From UPI to tokenization and BNPL integrations, Juspay has remained ahead of the curve.

About Kedaara Capital

Kedaara Capital is a Mumbai-based private equity firm known for backing high-growth Indian companies with long-term capital and operational guidance. Their investment in Juspay is a strategic bet on the future of India’s digital economy.

What’s Next for Juspay?

Although this was a secondary round, industry watchers believe Juspay could be eyeing a public listing (IPO) in the next 2–3 years. With a strong enterprise client base, advanced tech stack, and booming market, it is well-positioned to expand into:

-

Cross-border payment enablement

-

AI-powered fraud detection

-

Open banking platforms

-

Embedded finance APIs

Frequently Asked Questions (FAQs)

1. What is a secondary funding round?

A secondary round involves the sale of shares by existing investors. The funds go to shareholders rather than the company. It often occurs when early investors want to cash out or reduce their stake.

2. Will Juspay use this $60 million for product development or expansion?

No. Since this was a secondary round, the money went to existing shareholders. However, the transaction reflects investor confidence, which may attract primary investments in the future.

3. What does Juspay’s valuation doubling mean?

It means the market value of Juspay has increased significantly, now standing at over $900 million. This suggests strong financial performance and high future growth expectations.

4. Who are Juspay’s main clients?

Juspay powers payments for major Indian brands like Amazon, Swiggy, Flipkart, PhonePe, and Ola.

5. Is Juspay profitable?

While Juspay hasn’t publicly disclosed full profitability numbers, it is known for running a lean operation and is focused on sustainable growth.

6. When did Juspay last raise funds?

Juspay last raised $60 million in a Series C round in December 2021, led by SoftBank Vision Fund 2.

7. Could Juspay go public?

Yes. Given its size, client base, and valuation trajectory, Juspay is seen as a strong candidate for an IPO in the near future.

Conclusion

Juspay’s latest funding round is a clear signal of investor faith in the company’s future as a leader in both domestic and international payment solutions. With regulatory approval, global expansion underway, and a focus on AI-driven innovation, Juspay is redefining what modern fintech infrastructure looks like in India and beyond.

As the company navigates competition and scales new heights, it remains a critical player in the digital transformation of global commerce.

ALSO READ OUR LATEST BLOG: Grow Indigo Secures $10 Million Funding from British International Investment to Expand Sustainable Agriculture Initiatives